- STR Scout

- Posts

- 🔥 Housing Crisis Hits STRs: Rising Inventory & Forced Sales Shake the Market

🔥 Housing Crisis Hits STRs: Rising Inventory & Forced Sales Shake the Market

🏠 The Top 10 Trending STR Homes for Sale

TODAY’S SPONSOR:

STR operating costs are rising and revenues are shrinking for many operators today. It’s time to find out if can you save on your annual STR insurance premium.

The housing market is shifting fast, and short-term rental investors are feeling the pressure. Inventory is rising in key STR markets, price drops are accelerating, and a wave of motivated sellers is turning into distressed sales.

At the same time, new opportunities are emerging for STR buyers looking to enter the market at a discount.

This week’s STR Scout newsletter breaks down the latest trends shaping the market:

🔹 STR Classifieds – Handpicked short-term rental listings with strong ROI potential in shifting markets.

🔹 STR Market Shake-Up – Rising inventory, falling prices, and why some investors are racing to sell before deeper corrections hit.

🔹 STR News Nuggets – Florida’s fight against corporate homebuyers, and new travel trends shaping demand.

🔹 Housing & Economic Report – Mortgage rates, and key data points driving real estate decisions.

The STR market is evolving, and now more than ever, it’s critical to stay ahead of the trends.

Let’s dive in.

— The STR Scout Team

⛷️ $307K | Bartlett, NH: 2BD, 1BA condo in Linderhof Resorts. Overlooks golf course with mountain views. $36K+ STR income (2024). Smart upgrades. View Post

🌲 $325K | Ellijay, GA: 1BD, 1BA tiny home STR with bunk area. Highly profitable rental with three decks, hot tub, and secluded feel. Turnkey and fully furnished. View Post

🏡 $335K | Hampton, VA: 4BD, 2BA renovated home with open-concept layout, hardwood floors, and custom upgrades. Fully fenced backyard. Near beaches and Hampton University. View Post

🏰 $350K | Kissimmee, FL: 3BD, 2BA townhouse in gated resort 1.4 miles from Disney. Thriving STR with water views, smart-home features, and modern upgrades. View Post

🌊 $369K | Holiday, FL: 3BD, 2BA updated waterfront home with private dock and boat lift. Profitable Airbnb with stunning views. No flooding or storm damage. View Post

🏡 $439K | Waynesville, NC: 3BD, 2BA thriving STR near Great Smoky Mountains. Cozy fireplace, spacious deck, and secluded setting. Minutes from downtown. Income potential. View Post

🏖️ $560K | Bear Lake, MI: 4BD, 2BA turnkey vacation rental near Lake Michigan. Fully renovated with prime location near Arcadia Bluffs Golf and Crystal Mountain. View Post

🏔️ $675K | Sevierville, TN: High-performing STR with $162K gross income (2023-24) and 87% occupancy. Ideal for 1031 exchange. Contact for financials. View Post

🔥 $775K | Nashville, TN: 4BD, high-performing STR in East Nashville. Sleeps 12, rooftop deck, game room, and fire pit. Minutes from Broadway. Sold fully furnished. View Post

🪵 $800K | Pigeon Forge, TN: 3BD, 3BA high-performing STR with $105K gross income (2024). Features a private heated indoor pool, hot tub, and game loft. Prime location near attractions. View Post

Housing Crisis Hits STRs: Rising Inventory & Forced Sales Shake the Market

A Follow-Up to the Hidden Foreclosure Crisis: The Impact on Short-Term Rental Investors

Earlier this week, we explored the hidden foreclosure crisis—a growing issue influenced by banks and government policies that have delayed the release of distressed properties into the market. While foreclosures are an important indicator, they are just one piece of a broader shift in real estate trends affecting short-term rental (STR) investors.

STR investors have benefited from years of strong demand, rising home values, and favorable lending conditions. However, with today’s higher mortgage rates, increased operating expenses, and softening demand in key vacation markets, many investors are facing new financial pressures.

While some may see this as a temporary slowdown, others are struggling to maintain profitability and are considering selling to lock in equity gains before further market corrections occur.

As we analyze the evolving landscape, it's clear that the market is transitioning from a period of rapid appreciation to one where investors must navigate a more complex and uncertain environment. Understanding these trends will be crucial for those looking to adapt and position themselves for long-term success.

From Motivated Sellers to Desperate Sellers

During the peak of the market, sellers could list a home at an inflated price and expect a bidding war. That reality is gone. Now, properties are not moving and buyer demand is at a near stand still.

High mortgage rates, increasing operating costs, and economic uncertainty are forcing many STR property owners—especially those in STR-heavy markets—to offload assets at steeping discounts.

Markets Where Inventory is Rising, But Prices Are Falling

Real estate expert Melody Wright, host of M3 Market Update, has been tracking these shifts closely. She describes a housing market where sellers once motivated by choice are now selling out of necessity.

"Motivation is morphing into distress," Melody warns. "Homeowners who once believed they could sell for top dollar are now realizing that buyers aren’t coming, and price cuts are their only way out."

Her latest findings show a clear trend: Inventory is piling up, but instead of triggering a buying frenzy, prices are falling. This is happening in both overbuilt metro areas and popular STR destinations:

Short-Term Rental Hotspots Facing Price Declines

Boca Raton, FL

Bozeman, MT

Cape May, NJ

Carlsbad, CA

Coeur d'Alene, ID

Costa Mesa, CA

Hoboken, NJ

Oceanside, CA

Sedona, AZ

Sevierville, TN

Ventura, CA

Winter Garden, FL

Overbuilt Metro Areas Where Prices Are Dropping

Asheville, NC

Austin, TX

Charleston, SC

Chicago, IL

Denver, CO

Las Vegas, NV

Los Angeles, CA

Myrtle Beach, SC

Nashville, TN

Portland, OR

Salt Lake City, UT

Scottsdale, AZ

Washington, DC

West Palm Beach, FL

These markets share a common issue: too many homes, not enough buyers. While mainstream headlines focus on housing shortages, the reality is that we have an oversupply of unaffordable homes that no one can buy.

The Link Between Rising Inventory and Foreclosures

The hidden foreclosure crisis we exposed last week is now colliding with a growing surplus of unsold homes. This means the market is could to entering a self-reinforcing downward cycle trend throughout 2025:

Foreclosures Increase – Banks move on delinquent loans they’ve been holding back since the pandemic and continue to delay foreclosures with forebearance and mods (a temporary patch to try to stop the bleeding, keeping foreclosure numbers artificially low).

More Inventory Hits the Market – As distressed sales rise, unsold builder inventory and STR investor liquidations flood the market.

Prices Drop Further – Increased supply forces sellers to slash prices to attract the few buyers who remain. Each lower priced sale creates lower priced comp forcing downward pressure on pricing.

Buyers Wait for Bigger Discounts – Seeing price drops, buyers hold off, waiting for even better deals. Sellers race to the door if prices start to fall, too preserve equity gains.

More Sellers Are Forced to Sell – Many homeowners struggling with high costs have no choice but to sell at a loss. Many investors who want to lock in equity gains may sell as they see prices falling, creating even more supply.

This cycle isn’t theoretical—it’s already happening.

"Foreclosure starts jumped 50% month-over-month and 29% year-over-year," Melody points out, citing Black Knight data. "That means lenders are finally moving on distressed properties, and that’s going to add even more downward pressure on prices."

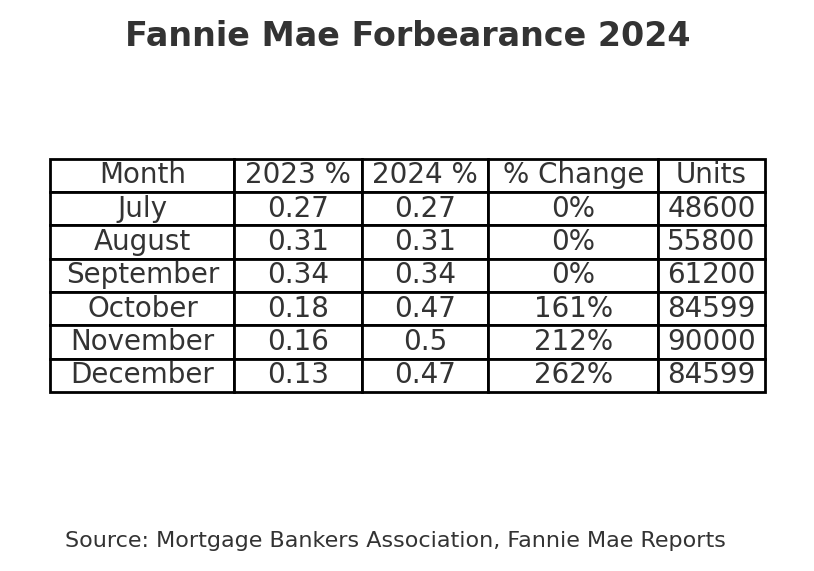

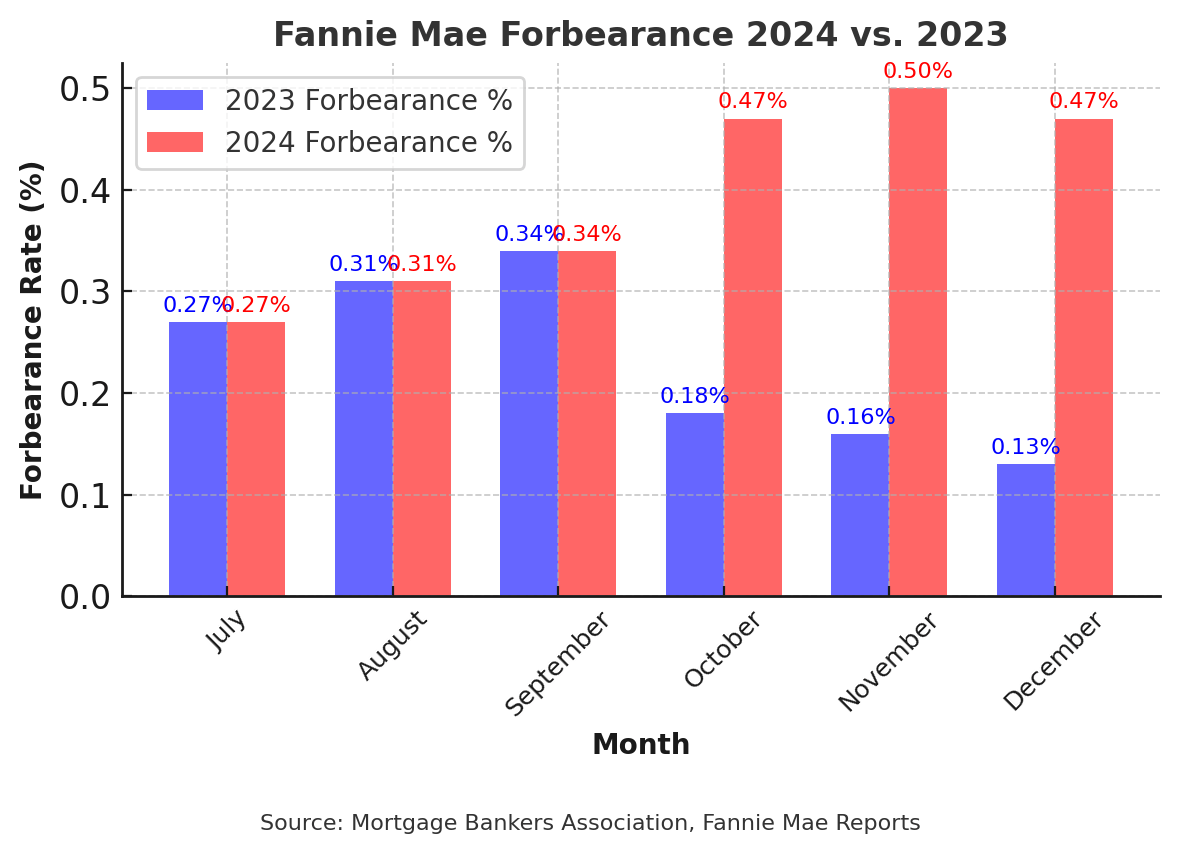

Fannie Mae foreclosure (forebearance) workouts spiked the second half of 2024.

The first six months of 2024 showed relatively stable forbearance rates. However, a noticeable spike occurred in the last quarter of 2024—an example of bank foreclosure prevention efforts that, in 2008, would have been reported as foreclosures. Unfortunately, forbearance workouts are just kicking the can down the road.

What All This Means for Short-Term Rental Investors

STR investors who entered the market in the past few years at record-high prices are now feeling the squeeze on cashflow and equity growth. Higher mortgage rates, rising insurance premiums, increased competition, and lower nightly rates mean that many properties are no longer cash flowing. You need to work both harder, and smarter today for the returns that make sense.

STR owners with negative cash flow must either sell or absorb losses indefinitely.

Investors who used high-leverage loans are trapped, unable to refinance or sell without taking a loss (could lead to a future short-sale repeat rally).

Markets that once saw rapid appreciation (Austin, Scottsdale, Boise) are reversing course, making quick exits impossible. DOM trends are rising in most markets, and rising inventory compounds this trend.

Many investors who bought low are selling to lock in equity (paper gains), flooding the market with even more supply.

This means that STR-heavy markets could see even steeper price corrections than traditional housing markets. We need to pay close attention.

The Bottom Line: The Housing Market’s "Shock & Awe" Moment is Coming

As Melody describes the current market, we are entering its "shock and awe" phase—where sellers realize that buyers are no longer willing to meet their price, and forced liquidations become widespread. This is happening in both vacation and traditional STR metro markets.

"We’re about to see true price discovery," she warns. "For the past two years, people thought they could wait it out. Now they can’t wait anymore, and reality is setting in."

Key Takeaways for Investors

Foreclosures are accelerating. Distressed sales are increasing, which will put downward pressure on prices.

Rising inventory signals market strain. Builders and short-term rental (STR) investors are motivated to sell, reflecting growing supply-side pressures.

Overbuilt and STR-heavy markets face the steepest declines. Areas with excess development and high STR concentrations will likely see the most significant price corrections.

Patience is key. As more distressed inventory enters the market, price adjustments will continue. Timing matters.

What STR Scout is Watching

We are closely monitoring price levels relative to 2019 median values, before the artificial market spike. Many markets may revert to pre-pandemic price trends as supply outweighs demand.

For buyers: Opportunities will emerge, but strategic patience is crucial—catching a falling knife remains a risk.

For sellers: Price adjustments will be necessary to move properties in 2025. Setting realistic expectations is essential.

The real question isn’t if the market correction will hit STR markets—it’s how prepared you are when it does.

🏡 New Orleans STRs Brace for the Super Bowl Rush. Short-term rental owners in New Orleans are gearing up for a Super Bowl-driven boom, but city regulations could make it tricky. With heightened enforcement against illegal rentals and concerns about housing availability, some hosts worry they’ll miss out on peak demand. Visitors, on the other hand, are scrambling for accommodations, facing higher prices and stricter booking policies. Super Bowl-driven boom

📉 Vacasa Faces Crossroad Amid Another Takeover Bid. Vacation rental giant Vacasa has received an unsolicited acquisition proposal from Davidson Kempner Capital Management. While Vacasa has yet to make a decision, analysts suggest the offer signals deeper challenges in the short-term rental market, including regulatory pressures and slowing demand in key regions. Investors are watching closely as the company weighs its next steps. Acquisition proposal

🤝 Vacation Rental Tech Merger Aims to Shake Up the Industry. A new joint venture between Tropical Escape Holidays and CiiRUS is promising to "redefine" vacation rental management with better technology and streamlined guest experiences. The partnership hopes to help property owners maximize revenue while improving the overall rental process for travelers. As competition grows, industry players are increasingly turning to tech-driven solutions. Joint venture

🏘️ Florida Bill Targets Corporate Homebuyers. A new bill in Florida aims to curb corporations from buying up single-family homes, a move intended to keep properties accessible for individual buyers. Lawmakers argue that large investors are driving up prices and squeezing out local residents, especially in popular vacation rental markets. If passed, the legislation could significantly impact the short-term rental landscape. Curb corporations

🛫 Direct Flights Fuel Tourism in the Yellowstone Region. The Greater Yellowstone area is seeing a boost in tourism thanks to new direct flight routes. Visitors are flocking to Montana, bringing more business to short-term rental owners and local hospitality providers. The increased accessibility is expected to drive more demand for vacation rentals, especially during peak seasons. Boost in tourism

🎿 Whitefish Stays Independent as Ski Resorts Consolidate. While many ski resorts are getting scooped up by corporate giants, Montana’s Whitefish Mountain Resort is holding onto its independent status. This appeals to travelers looking for a more authentic, less commercialized experience—an advantage for nearby short-term rentals. With strong visitor demand, local hosts are benefiting from the resort’s commitment to staying unique. Independent status

🏠 10 Tips for Buying a Profitable Rental Property. Purchasing a rental property can be a lucrative investment, but it requires careful planning. Experts recommend choosing locations with strong demand, calculating long-term costs, and understanding local regulations before making a move. With housing markets shifting, strategic investments are key to success. Profitable rental property

💰 How to Defer Capital Gains on Real Estate Sales. Savvy investors are using tax strategies to delay capital gains payments when selling properties. Techniques like 1031 exchanges and opportunity zone investments can help reduce tax burdens and reinvest profits efficiently. As tax laws evolve, understanding these options is becoming more important for real estate investors. Defer capital gains

🛩️ Travel Smarter in 2025 with These Key Resources. Planning a hassle-free trip this year? From digital nomad essentials to cost-saving flight hacks, travel experts are sharing their best tips for making the most of your adventures. Whether booking a short-term rental or managing expenses abroad, the right tools can make all the difference. Travel experts

👥 How to Pick the Perfect Airbnb for a Group Stay. Finding an Airbnb that suits a large group can be tricky, but experienced travelers have tips to make it easier. Prioritizing space, checking for hidden fees, and reading reviews carefully can help avoid unexpected surprises. Whether for a family reunion or a getaway with friends, planning ahead is key. Group stay

🌍 Backpacking Through Europe on a Budget. One traveler shared their experience of seeing multiple European countries in just two weeks—without breaking the bank. From finding cheap flights to staying in affordable short-term rentals, their journey proves that international travel doesn’t have to be expensive. For budget-conscious adventurers, strategic planning is everything. Backpacking experience

💼 Retirement Planning for a Life of Travel. More retirees are designing their golden years around travel, but financial preparation is crucial. Experts suggest budgeting wisely, choosing affordable destinations, and considering part-time remote work to sustain a nomadic lifestyle. With the right strategy, retirement can be the perfect time for long-term travel adventures. Financial preparation

🏗️ Tariff Pause Brings Relief to Home Builders. A temporary halt on tariffs for materials from Canada and Mexico is welcome news for the housing industry. Builders hope this will help stabilize costs and keep housing developments—including short-term rental investments—on track. With affordability still a major concern, any break in supply costs is a step in the right direction. Tariff pause

📊 Weekly Housing & Economic Trends (Feb 7, 2025)

This week, the U.S. housing market exhibited stability, with mortgage rates experiencing a slight decline. However, housing inventory remains constrained, posing challenges for prospective buyers. On the economic front, key indicators presented a mixed outlook, reflecting ongoing uncertainties in the broader economy.

🏡 Housing Market Trends

Metric | Value | Change | Prior | YoY Change |

|---|---|---|---|---|

30-Yr FRM | 6.94% | -0.01% | 6.95% | +0.25% |

15-Yr FRM | 6.10% | -0.02% | 6.12% | +0.14% |

HMI | 55 | 0 | 55 | -5 |

Starts | 1.36M | 0 | 1.36M | +0.08M |

Permits | 1.33M | 0 | 1.33M | +0.06M |

Median Rent | $1,580 | 0 | $1,580 | -6.5% |

Inventory | 1.52M | 0 | 1.52M | +9.3% |

Data sourced from recent housing market analyses.

📅 Economic Calendar

Date | Event | Actual | Forecast | Prior |

|---|---|---|---|---|

Feb 3 | Mfg PMI | 49.0 | 49.0 | 49.3 |

Feb 4 | Factory Ords | 0.7% | 0.7% | -0.4% |

Feb 5 | ADP Jobs | 155K | 155K | 122K |

Feb 6 | Jobless Clms | 210K | 214K | 207K |

Feb 7 | Nonfarm Payrolls | 143K | 170K | 256K |

Data compiled from recent economic reports.

🔍 Key Takeaway:

The housing market remains relatively stable with minor fluctuations in mortgage rates. However, limited inventory continues to challenge buyers. Economically, while manufacturing and employment data show areas of concern, the overall outlook remains cautiously optimistic. Stakeholders should monitor upcoming data releases to gauge potential shifts in market dynamics.

Sponsors: Would you like to explore exclusive sponsorship opportunities? Email [email protected].

Advertisers: Are you interested in advertising your property or product? Email [email protected].